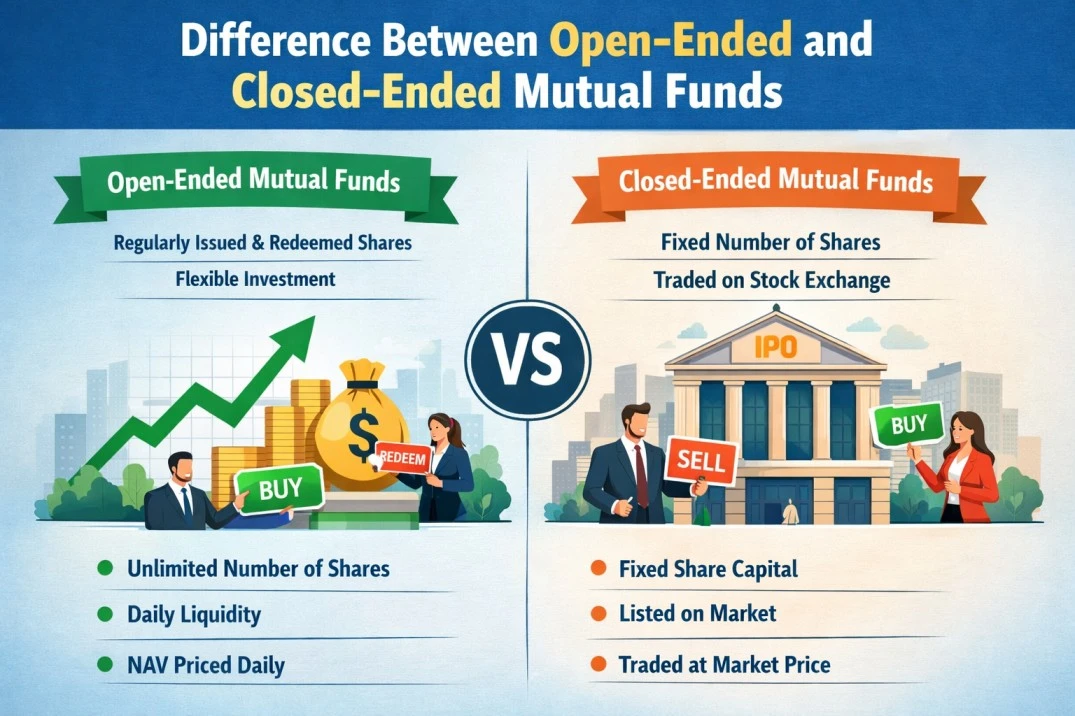

Most new investors start their mutual fund journey by comparing returns, believing that performance alone separates one scheme from another. But as you spend more time understanding how mutual funds actually work, the difference between open-ended and closed-ended mutual funds becomes just as important as choosing the right category. These structures decide how freely you can invest, when you can redeem, and how comfortably your money fits into your financial routine.

For beginners, this distinction often goes unnoticed because both funds look similar on the surface. But once you see how each structure handles liquidity, flexibility, and investor behaviour, the choice starts making much more sense. Platforms like mutual fund wala emphasise this early on because understanding the fund’s structure can help investors align their decisions with their goals rather than market noise.

What Are Open-Ended Mutual Funds?

An open-ended mutual fund stays available for investment and withdrawal on all working days. You can buy or sell units whenever you need, and the transaction happens at the fund’s daily Net Asset Value (NAV). There is no lock-in or fixed maturity, which makes the structure feel flexible and easy to understand.

For a beginner, the simplest way to think about an open-ended fund is this: your money isn’t tied up. You are free to increase or decrease your investment at your own pace, based on your financial situation and market conditions.

Advantages and Disadvantages of Open-Ended Mutual Funds

Advantages

- Easy to buy and sell on any working day

- Ideal for both Systematic Investment Plan (SIP) and Lump-Sum investments

- Daily NAV helps track performance smoothly

- Allows rebalancing and portfolio adjustments

- Supports emergency needs due to high liquidity

Disadvantages

- High flexibility can tempt beginners to redeem early

- Market volatility may influence impulsive decisions

- Frequent switching can reduce long-term gains

- Sudden inflows/outflows may affect fund management

- Requires some discipline to stay invested

What Are Closed-Ended Mutual Funds?

In contrast to Open-Ended Mutual Funds, closed-ended mutual funds operate in a more structured manner. It accepts investments only during the New Fund Offer (NFO). NFOs are like Initial Public Offerings for mutual funds, in which mutual funds raise capital from investors to launch a new scheme.

After the fundraiser, it closes to new purchases. Once you invest, your money remains locked until the fund matures. These schemes are listed on stock exchanges but are not liquid due to low trading volume. This means that, even though the fund is technically tradable, selling your units early may not be easy, and the price may not reflect the fund’s actual NAV.

For beginners, think of a closed-ended fund as a time-bound investment in which you invest at the beginning, and the money stays invested for the full term. This structure can be helpful if you want to remain invested without the temptation to exit during market volatility.

Advantages and Disadvantages of Closed-Ended Mutual Funds

Advantages

- Lock-in period helps investors stay disciplined

- Fund managers get stable capital for the full duration

- No sudden redemptions, so portfolio strategy stays intact

- Useful for investors who tend to withdraw during volatility

- Offers exposure to full market cycles without interruption

Disadvantages

- Cannot redeem before maturity (except through the stock exchange)

- Exchange liquidity is low; prices may not match NAV

- SIP is not possible; only a lump-sum investment during NFO

- Timing of the NFO may not align with market valuations

- Limited flexibility for changing financial goals

- Lags in Performance

How These Structures Influence Real-World Investing

Once you understand the basics, the practical difference becomes clearer. Open-ended funds fit naturally into most financial plans because real life demands flexibility. Income changes, new responsibilities arise, emergencies come without warning, and markets move unpredictably. Having the ability to adjust your money easily becomes a meaningful advantage.

Closed-ended funds, on the other hand, remove emotional decision-making by locking the investment. This benefits investors who tend to exit during downturns or struggle with staying invested over long periods. The closed structure can help them ride out volatility and avoid interrupting long-term gains.

Both formats work, and they just support different kinds of investor behaviour. However, open-ended funds are the preferred mode of investment due to the option to invest through SIPs, which help build wealth in the long run.

Which One Should a Beginner Choose?

Most beginners find open-ended funds more comfortable because they fit naturally into everyday cash-flow needs. You can start small, build a habit through SIPs, and make changes as life evolves.

Closed-ended funds may suit investors who prefer committing to a specific time frame and do not want the flexibility to redeem early. Your choice should depend on your finances, liquidity needs, and risk appetite.

Frequently Asked Questions

01. What is an open-ended mutual fund?

Ans: An open-ended mutual fund allows investors to buy or redeem units on any business day. There is no fixed maturity, and liquidity is available throughout the year.

02. What is a closed-end mutual fund?

Ans: A closed-end mutual fund accepts investments only during the New Fund Offering and stays locked until maturity. Investors cannot redeem units with the fund before the end of the term.

03. Which is better: open-ended or closed-ended?

Ans: Neither is universally better. Open-ended funds suit investors who need liquidity, while closed-ended funds work for those comfortable with a fixed tenure.

04. Do closed-end funds give higher returns?

Ans: Not necessarily. Returns depend on the fund category, market cycles, and fund management.

05. Can I sell a closed-end fund before maturity?

Ans: Yes, some closed-end funds are listed on stock exchanges, but liquidity may be limited, and the price may not match the NAV.

Recent Post